Entertainment

January 26, 2024

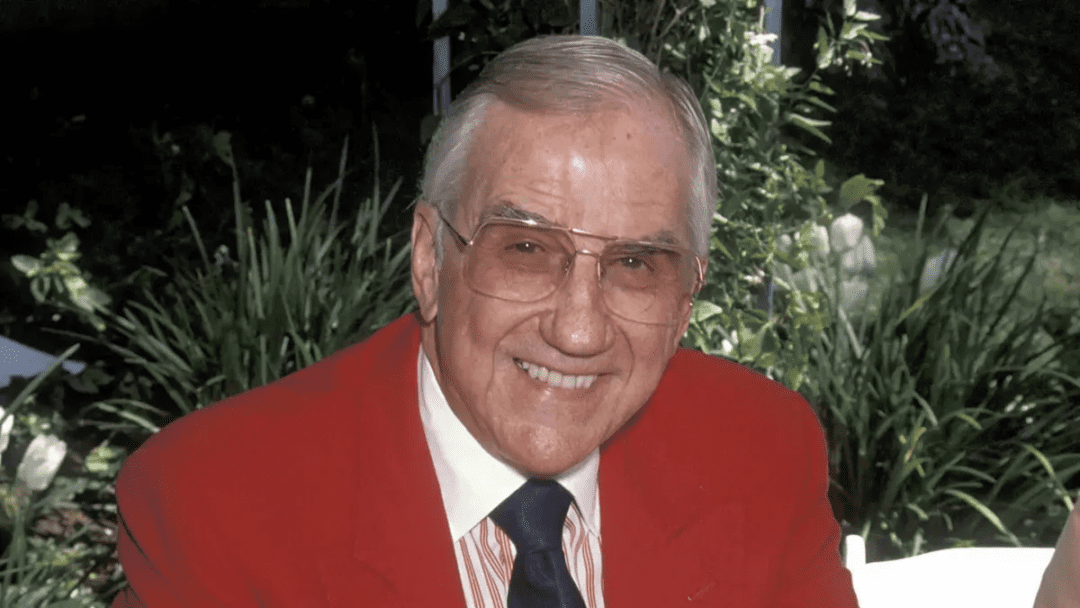

Ed McMahon Publishers Clearing House Connection Sparks ‘Mandela Effect’ Blame

Ed McMahon Publishers Clearing House Longtime television partner Johnny Carson According to some TV fans, Ed McMahon once served as…

Entertainment

December 20, 2023

Baby born with 26 fingers and toes in India is dubbed reincarnation of Hindu goddess

The reincarnation of a Hindu goddess has been suggested for a newborn baby born in India with 26 fingers and…

Lifestyle

December 19, 2023

Amuru Abam

Amuru Abam is a small but mighty community in Abam, in Arochukwu LGA of Abia State, Nigeria. It is in…

Entertainment

December 19, 2023

Gary Plauché, The Louisiana Dad Who Took Deadly Revenge On His Son’s Rapist On Live Television

A parent’s biggest nightmare is probably having their child kidnapped or sexually assaulted. After enduring both, Baton Rouge, Louisiana-based American…

Entertainment

December 19, 2023

Chinese livestreamer Brother Three Thousand who gained fame for his drinking challenges is found dead

Chinese livestreamer Brother Three Thousand who gained fame for his drinking challenges is found dead after downing seven bottles of…

Entertainment

December 19, 2023

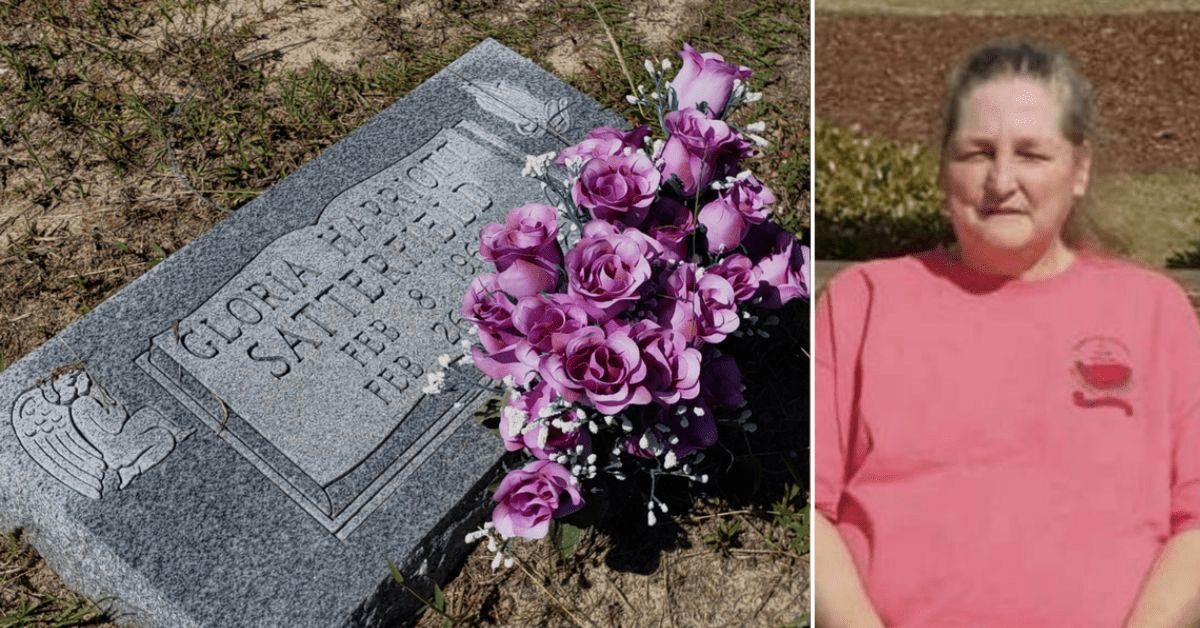

Gloria Satterfield Autopsy Results Revealed Online

Since Gloria Satterfield’s unfortunate passing in 2020, her death has generated a great deal of debate. At the home of…

Entertainment

December 19, 2023

Daniel Tibia Death – The Story of Gabriel Kuhn and Daniel Petry

Both 12-year-olds Gabriel Kuhn and Daniel Petry had a passion for the video game Tibia. The lives of the two…

Health & Wellness

December 19, 2023

Why does Farting feel good? Here are 6 reasons

Farting, also known as passing gas or flatulence, is a natural bodily function that can evoke various reactions from embarrassment…

How To

December 19, 2023

10 Ways to Prevent Flooding In Your Community

Flooding is a natural disaster that can have devastating consequences on communities, infrastructure, and the environment. As climate change intensifies,…

Celebrities

December 19, 2023

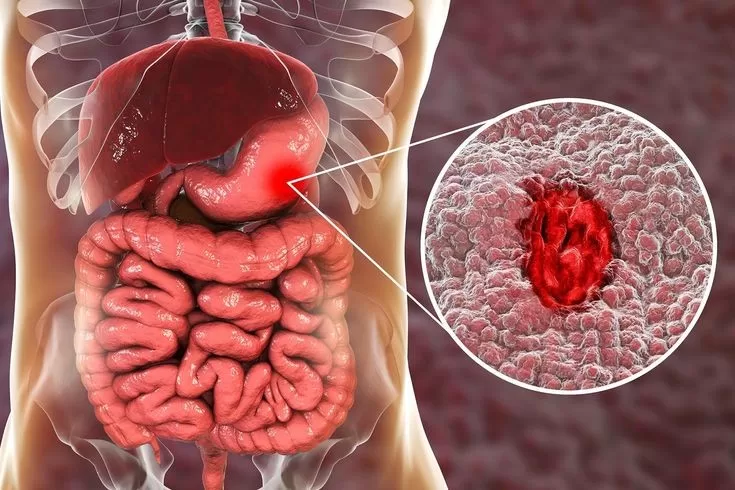

What happened to Solidstar? Solidstar Health update

Nigerian singer Joshua Iniyezo, popularly known by his stage name Solidstar, is battling mental health issues, his younger brother Joseph…