What is the highest currency in the world in 2023

Currency holds a significant role in international trade and finance, serving as a medium of exchange for goods and services. The value of a currency can vary greatly, and some currencies stand out for their high exchange rates against other currencies.

In this blog post, we explore the concept of the highest currency in the world in 2023, highlighting the factors that contribute to a currency’s value and examining the current contenders for the title.

What Is The Highest Currency in the World in 2023?

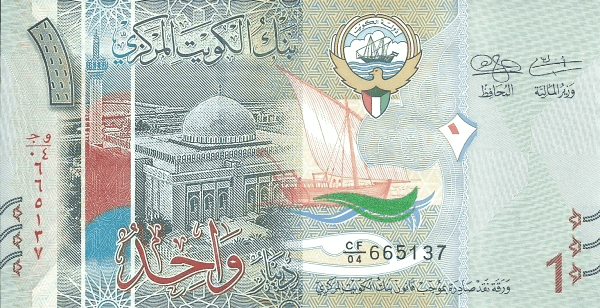

As of 2023, the Kuwaiti Dinar (KWD) holds the title of the highest currency in the world. The Kuwaiti Dinar has maintained its position for many years due to several factors, including Kuwait’s vast oil reserves, stable economy, and prudent fiscal policies. The currency is commonly used as a benchmark in currency trading and international finance.

SEE ALSO: Top 100 Highest Currencies In The World

Other currencies that have historically held strong positions include the Bahraini Dinar (BHD), Omani Rial (OMR), Jordanian Dinar (JOD), and British Pound Sterling (GBP). However, currency values fluctuate over time due to various economic and geopolitical factors, so it is essential to monitor changes in the global economic landscape.

Top 10 Highest Currencies In The World

The ranking of the top 10 highest currencies in the world is subject to change based on fluctuations in exchange rates and global economic conditions. However, as of the time of this writing, here is a general overview of the top 10 highest currencies:

- Kuwaiti Dinar (KWD): The Kuwaiti Dinar consistently ranks as the highest-valued currency in the world. It has a strong exchange rate due to Kuwait’s substantial oil reserves, economic stability, and prudent fiscal policies.

- Bahraini Dinar (BHD): The Bahraini Dinar is another currency that holds a high value. Bahrain’s strong financial sector, political stability, and economic diversification contribute to the currency’s strength.

- Omani Rial (OMR): The Omani Rial is the currency of Oman and is known for its high value. Oman’s economy, supported by oil exports and diversification efforts, contributes to the strength of the Omani Rial.

- Jordanian Dinar (JOD): The Jordanian Dinar is considered a strong currency due to Jordan’s political stability, strategic location, and efforts to attract foreign investments. It holds its value well in the global market.

- British Pound Sterling (GBP): The British Pound Sterling is the currency of the United Kingdom and has a long-standing reputation as one of the highest-valued currencies. The UK’s stable economy, strong financial services sector, and historical influence contribute to the strength of the Pound Sterling.

- Cayman Islands Dollar (KYD): The Cayman Islands Dollar is the currency of the Cayman Islands, a British Overseas Territory. The Cayman Island’s well-developed financial services industry and economic stability contribute to the currency’s high value.

- Swiss Franc (CHF): The Swiss Franc is the currency of Switzerland. It is widely regarded as a safe haven currency due to Switzerland’s long-standing political neutrality, stable economy, and strong banking system.

- Euro (EUR): The Euro is the currency used by many countries within the Eurozone, including Germany, France, Italy, and Spain. It is the second most widely held reserve currency globally, reflecting the economic strength of the Eurozone.

- US Dollar (USD): The US Dollar is the currency of the United States and is one of the most widely recognized and traded currencies worldwide. It is often used as a benchmark for global financial transactions due to the economic strength of the United States.

- Canadian Dollar (CAD): The Canadian Dollar is the currency of Canada and ranks among the highest-valued currencies. Canada’s stable economy, natural resource wealth, and sound fiscal policies contribute to the strength of the Canadian Dollar.

READ ALSO: Top 10 Local Airlines in Nigeria

Understanding Currency Value

The value of a currency is determined by several factors, including economic stability, inflation rates, interest rates, political stability, and market forces of supply and demand. A strong currency often indicates a robust economy and investor confidence, making it highly sought after in international trade.

Factors Influencing Currency Strength

Economic Stability

Countries with stable and growing economies tend to have stronger currencies. Factors such as low inflation, high employment rates, and sustainable economic growth contribute to currency strength.

Interest Rates

Higher interest rates attract foreign investments, increasing the demand for a country’s currency and potentially strengthening its value.

Political Stability

Countries with stable political systems and well-established institutions are more likely to have stronger currencies as they inspire investor confidence and encourage economic growth.

Natural Resources

Countries rich in natural resources, such as oil, gas, or precious metals, may experience increased demand for their currency due to exports, which can strengthen their value.

Trade Balance

A country with a positive trade balance, exporting more than it imports, may have a stronger currency due to increased demand for its products and services.

Conclusion

Currency strength is influenced by a variety of economic, political, and market-related factors. While the Kuwaiti Dinar currently holds the title of the highest currency in the world in 2023, it is important to recognize that currency values can fluctuate over time due to changing economic conditions.

As global markets evolve, the strength of a currency can shift, emphasizing the need for continuous monitoring and analysis. Understanding the factors that contribute to currency strength provides valuable insights into the dynamics of international finance and the global economy.