Who Is a Broke Man? Everything to know

Who Is a Broke Man? The term “broke man” is often used to describe a person who is experiencing financial difficulties or is unable to meet traditional societal expectations of financial success. However, it is essential to approach this term with nuance and empathy, as labeling someone solely based on their financial situation can perpetuate harmful stereotypes and overlook the complexities of individual circumstances.

In this blog post, we will explore who a broke man truly is, debunking stereotypes, and redefining our perspectives to foster a more compassionate understanding.

Who Is a Broke Man Beyond Financial Struggles?

A broke man is someone who may be facing temporary financial hardships or may not currently have the financial resources they desire. It is crucial to remember that financial struggles do not define a person’s worth or potential. Everyone experiences ups and downs in life, and judging someone solely on their financial status ignores the vast range of qualities and abilities they possess.

READ ALSO: 20 Reasons Why You Shouldn’t Date A Broke Guy

How to overcome being a broke man?

Overcoming being broke can be a challenging journey, but with determination, discipline, and a positive mindset, it is possible to improve your financial situation and achieve stability. Here are some steps to help you overcome being broke:

- Assess Your Finances: Start by taking an honest look at your financial situation. Calculate your income, expenses, debts, and savings. This assessment will give you a clear picture of where you stand and where improvements can be made.

- Create a Budget: Develop a realistic budget that allocates your income to essential expenses like rent, utilities, food, and debt repayment. Cut back on non-essential spending and prioritize saving money.

- Set Financial Goals: Define short-term and long-term financial goals. Whether it’s paying off debts, building an emergency fund, or saving for a specific purpose, having clear objectives will motivate you to stay on track.

- Reduce Debt: High-interest debts can be a significant burden on your finances. Focus on paying off debts with the highest interest rates first while making minimum payments on others. Consider debt consolidation or negotiating with creditors for more manageable payment plans.

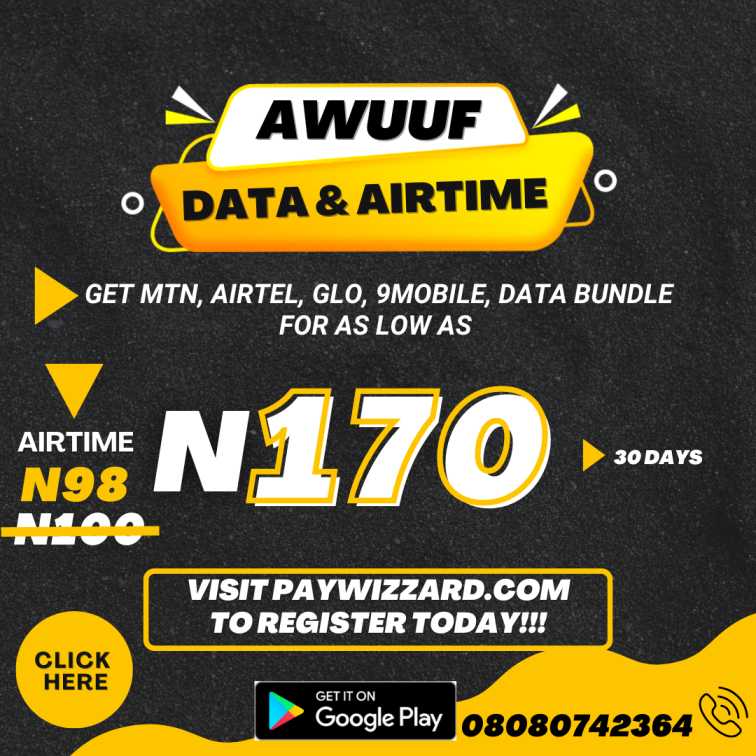

- Increase Your Income: Look for ways to increase your earnings, such as taking on a part-time job, freelancing, or selling items you no longer need. Utilize your skills and talents to generate extra income.

- Build an Emergency Fund: Start saving a small amount regularly to create an emergency fund. Having a financial cushion will help you avoid falling back into a financial crisis when unexpected expenses arise.

- Educate Yourself on Personal Finance: Read books, attend workshops, or take online courses to enhance your financial literacy. Learning about money management and investment strategies can help you make informed decisions.

- Seek Professional Advice: If your financial situation is overwhelming, consider consulting a financial advisor or a credit counselor. They can offer personalized guidance to help you develop a plan to get back on track.

- Avoid Temptations: Stay away from unnecessary expenses and impulse purchases. Focus on your financial goals and practice discipline to resist spending money on things you don’t truly need.

- Surround Yourself with Supportive People: Share your financial goals with friends and family who can provide encouragement and hold you accountable. Having a support system can make the journey to financial stability less daunting.

- Be Patient and Persistent: Overcoming being broke is not an overnight process. It requires time, effort, and consistency. Stay committed to your financial plan and celebrate small victories along the way.

- Stay Positive: Maintaining a positive mindset is essential during challenging times. Avoid dwelling on past financial mistakes and instead focus on the progress you are making and the possibilities for a better future.

Remember, overcoming being broke is a journey, and setbacks may occur. Be kind to yourself, stay focused on your goals, and keep moving forward. With determination and perseverance, you can improve your financial situation and build a more stable and secure future.